are assisted living expenses tax deductible irs

Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Which means a doctor or nurse with diagnosing abilities has stated that the.

Tax Deductions For Assisted Living

But did you know some of those costs may be tax deductible.

. Qualified long-term care services have been defined as including the type of daily personal care services provided to Assisted Living residents such as help with bathing dressing continence. Tax Deductions for Assisted Living Expenses. The federal government has recognized the financial burden of many families with a loved one in care by offering a tax deduction that can help Assisted Living residents.

A private letter from the Internal Revenue Service explains that meals and lodging costs for an assisted living stay may be deducted as medical expenses if the individual is in the facility for qualifying medical reasons. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. If you and your spouse are over the age of 65 you can deduct medical expenses that exceed 75 of your adjusted gross income. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A.

A TurboTax QA meanwhile explains that assisted living expenses are tax deductible when the patient cant care for themselves as certified by a licensed healthcare practitioner. If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

The Internal Revenue Service IRS rules for assisted living expenses are laid out in IRS Publication 502 Medical and Dental Expenses. To qualify for cost-of-living deductions there must be a plan of care prepared listing all of the services that the resident will receive to qualify for the deduction. Long-Term Care Assisted Living Deductions Any long-term care services such as assisted living nursing home care and in-home skilled nursing services can be deducted as medical costs under certain circumstances.

Using this tax deduction can save you or your parent money on the cost of medical and care expenses that make up part of the cost of Assisted Living. Assisted living facilities primarily help residents with non-medical needs. John properly filed his 2020 income tax return.

Medical expenses and some. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care services on your taxeswith some qualifications and restrictions of course.

But did you know some of those costs may be tax deductible. See the following from IRS Publication 502. Yes in certain instances nursing home expenses are deductible medical expenses.

Chronic Illness and Tax Deductible Status. Tax deductions are the perfect example. Individuals in assisted care or relatives supporting dependents in assisted living facilities can usually deduct some health care expenses as long as the sick individual meets certain qualifications.

To qualify the long-term care services must involve personal care services such as. The letter explains the types of conditions that would meet the standards in order to qualify these costs as tax deductible. He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021.

Much of the uncertainty stems from the challenge of determining what portion of a seniors monthly fees are considered medical care. Assisted Living Expenses and Tax Deductions While some families arent aware that they may be entitled to a tax deduction others who do know about it find the process too confusing to navigate. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill.

In order for assisted living expenses to be tax deductible the resident must be considered chronically ill. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill. Deducting Assisted Living Expenses Long-term care services are tax-deductible expenses on Schedule A according to the 1996 Health Insurance Portability Accountability Act HIPAA.

Although minor and infrequent medical services such as first-aid for a wound can sometimes be met on-site by nurses. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible.

If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Your spouse or another dependent can qualify as a deductible expense on your taxes.

For taxpayers under the age of 65 medical expenses must exceed 10 of your adjusted gross income. To qualify for this tax break expenses need to be itemized. The full list of medical expenses that qualify for a tax deduction can be found on page 23 of the IRS Tax Guide for Seniors and in IRS Publication 502.

If that individual is in a home primarily for non-medical reasons then only the cost of.

Can I Get Tax Deductions From Assisted Living Expenses

A Closer Look At Some Tax Deductions On Senior Care

Is Assisted Living Tax Deductible Five Star

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

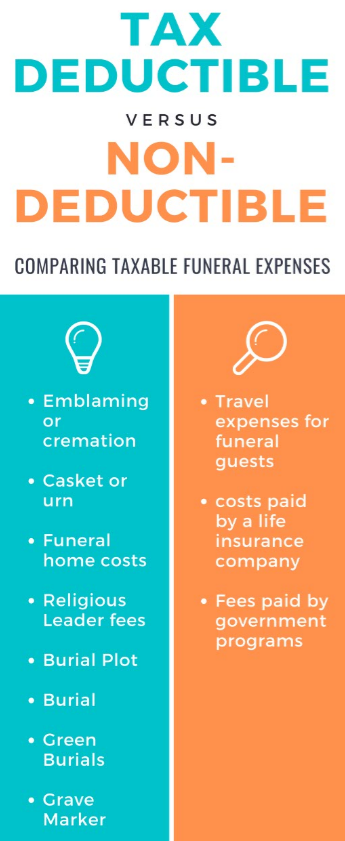

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Is Assisted Living Tax Deductible Medicare Life Health

Direct Payment Of Medical Expenses And Tuition As An Exception To The Gift Tax The American College Of Trust And Estate Counsel

What Assisted Living Expenses Are Tax Deductible Boise Id

Are Assisted Living Expenses Tax Deductible Medical Expense Info

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

What Tax Deductions Are Available For Assisted Living Expenses

Tax Deduction For Medical And Dental Expenses The Official Blog Of Taxslayer

Are Medical Expenses Tax Deductible

Common Health Medical Tax Deductions For Seniors In 2022